Are you tired of dealing with the hassle and inconvenience of managing global payments for your business? Do you struggle with complex payment processes and high fees? Introducing Wise Business – the all-in-one solution for global payments that will revolutionise the way you handle your business’s finances.

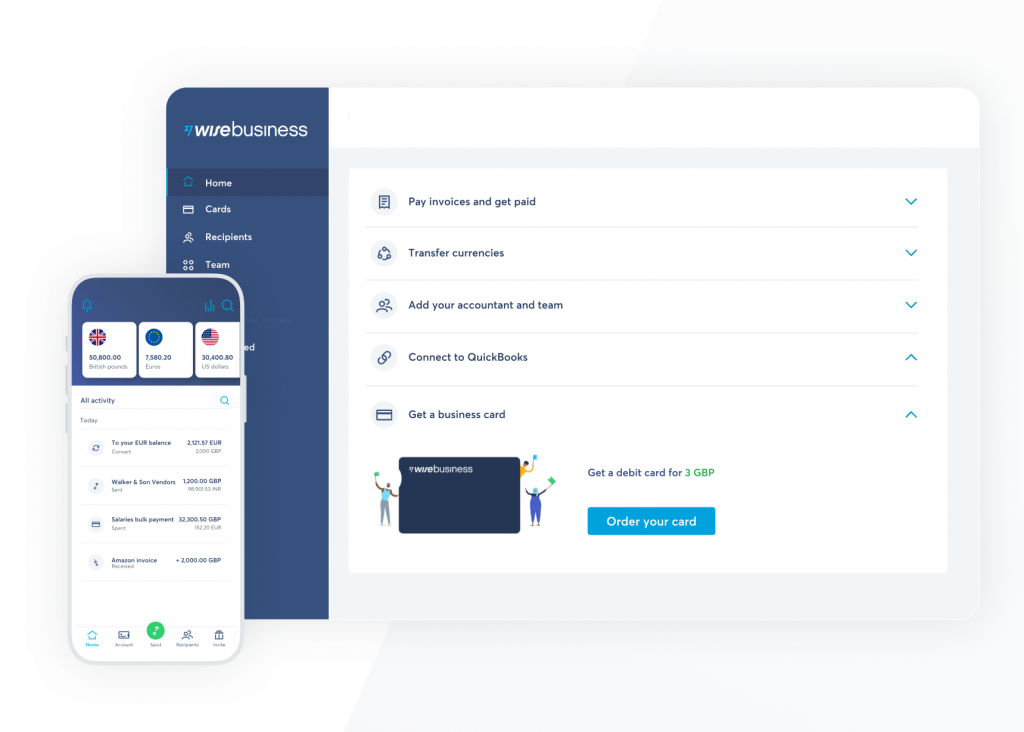

With Wise Business, you can easily set up local bank details, open a business account in multiple currencies, make instant payments, and integrate with popular accounting software. Read on to learn more about how Wise Business can benefit your business and help you streamline your payment processes.

Why use Wise Business?

Wise Business offers several benefits for businesses, such as the ability to easily set up local bank details for customers to pay into with trust, the option to create a business account across multiple currencies that can be scaled as needed, and the ability to make instant payments to suppliers and employees.

Sign up to Wise now and open your business bank account for £45, OR if you become a Launchese customer we’ll send you a link removing the £45 up front cost: https://launchese.com/wise

Additionally, Wise Business allows employees to spend across multiple currencies with ease and allows businesses to send hundreds of payments in one go across many currencies. Wise Business also integrates with popular accounting software such as Xero and QuickBooks, and offers control over spending through approval rules and spending limits for employees.

Instantly have local bank details for customers to pay into with trust.

With Wise Business, businesses can instantly set up local bank details for customers to pay into, providing them with a trusted payment option. Wise Business allows businesses to open a business account in 10 different currencies, including GBP, USD, and EUR, enabling them to receive payments in those currencies from across the world. Wise Business offers low receive and conversion fees, making it a cost-effective option for businesses.

Set up a business account across multiple currencies that fits as you scale.

Wise Business allows businesses to easily convert funds across their balances in multiple currencies. Setting up a business account with local details can be done quickly and easily without the need to leave the office. Wise Business also enables businesses to hold funds for cashflow and upcoming payments, providing them with greater control and flexibility for managing their finances.

Keep suppliers and employees happy with instant payments.

Wise Business allows businesses to make instant payments to suppliers and employees, helping to keep them happy and satisfied. Batch payments can be used to pay out up to 1000 payments across all available currencies for payroll, supplier payments, and expenses. International payments made through Wise Business are up to 19 times faster than Paypal, providing businesses with a convenient and efficient way to make payments. Additionally, businesses can set approval rules to ensure that only authorised payments are made from the account.

Sign up to Wise now and open your business bank account for £45, OR if you become a Launchese customer we’ll send you a link removing the £45 up front cost: https://launchese.com/wise

Let your employees spend across multiple currencies with no hassle.

Wise Business allows businesses to add team members to their account and give them access to only the features and permissions they need. This enables employees to spend across multiple currencies without hassle. Wise Business also offers the ability to create approval rules for added control over payments, and provides physical and digital cards for employees to use when making purchases. Additionally, Wise Business automatically converts across currencies when spending, eliminating the need for employees to do so themselves.

Send hundreds of payments in one go across many currencies.

Wise Business allows businesses to easily send hundreds of payments in one go across many currencies. As businesses grow and the number of payments increases, this feature can save time and effort by eliminating the need for manual payments. Wise Business offers the ability to pay to all available currencies using batch payments, and can save hours of manual payment processing time. This efficient payment solution ensures that suppliers and employees receive their payments quickly and efficiently.

Integrate with accounting software such as Xero and QuickBooks.

Wise Business allows businesses to easily integrate with popular accounting software such as Xero and QuickBooks. By connecting to these software programs, businesses can sync their transactions and save time and effort. Wise Business offers connections to two of the biggest accounting software programs globally, and allows businesses to sync unpaid bills from QuickBooks and Xero to be paid instantly. This integration provides faster reconciliation and keeps cashflow up to date with a bank feed connection.

Get it for FREE!

In summary, Wise Business offers a range of benefits for businesses, including the ability to easily set up local bank details, open a business account in multiple currencies, make instant payments to suppliers and employees, and integrate with popular accounting software. Additionally, Wise Business allows employees to spend across multiple currencies and offers the ability to send hundreds of payments in one go.

Launchese is a partner of Wise and can help entrepreneurs to get a Wise account. As a Launchese user, you can get a Wise Business account for free instead of paying the usual fee of £30.

Sign up to Wise now and open your business bank account for £45, OR if you become a Launchese customer we’ll send you a link removing the £45 up front cost: https://launchese.com/wise

“Maximizing Efficiency with Wise Business: A Comprehensive Guide”

- “Streamline Your Business with Wise: The Ultimate Solution for Global Payments”

- “Global Payments Made Easy: How Wise Business Can Benefit Your Business”

- “Revolutionizing Your Business with Wise: The All-in-One Solution for Global Payments”

- “Wise Business: The Key to Unlocking Global Payment Efficiency for Your Business”