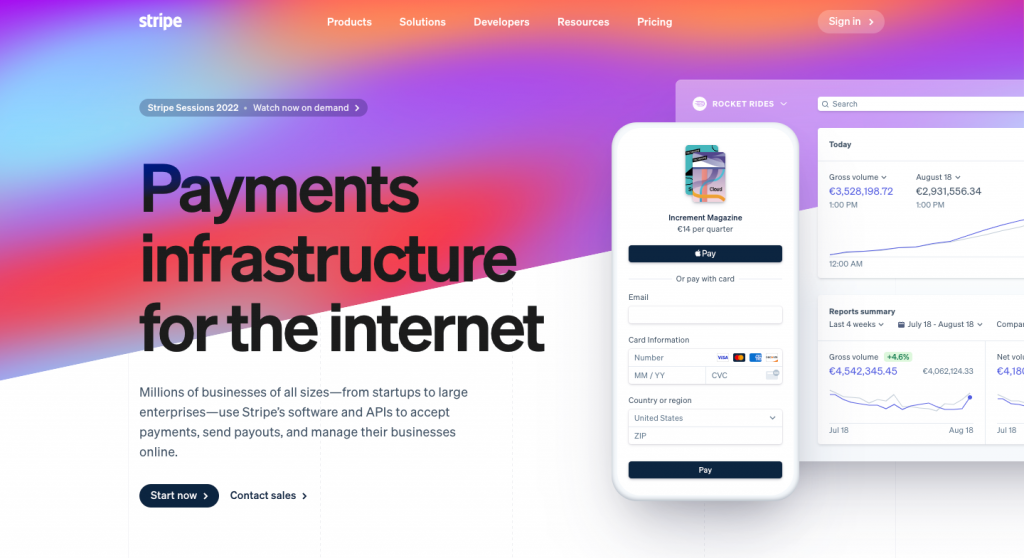

What is Stripe Payment Processing and How Does it Work?

Stripe is a technology company that provides an online payment platform for businesses and individuals. It offers a range of services including payment processing, subscriptions, and fraud detection. The Stripe platform allows users to accept payments, manage subscriptions, and handle other financial operations in a user-friendly and secure manner. Additionally, Stripe provides developers with APIs and other tools to integrate the platform into their own websites and applications.

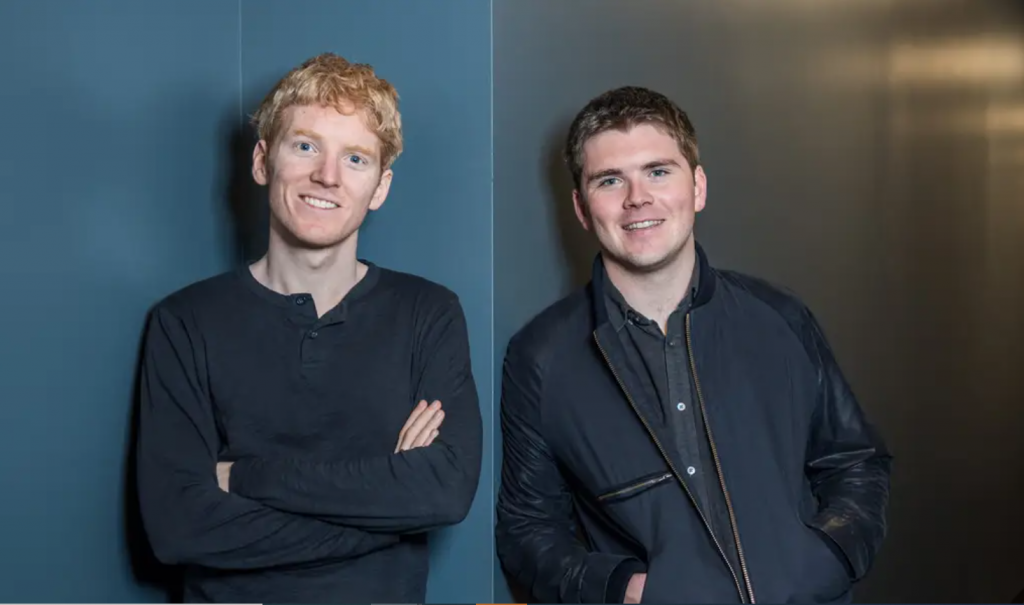

The History of Stripe: How Two Brothers Solved a Payment Processing Problem

Stripe was founded in 2010 by brothers Patrick and John Collison. The company was started as an online payment processing platform that was designed to make it easy for small businesses and individuals to accept payments over the internet.

The brothers had previous experience with online payments, as they had created an online marketplace for students to buy and sell textbooks. In the process, they noticed how difficult and cumbersome it was for individuals to accept payments online, and they decided to create a platform that would solve that problem.

The company began in a small apartment in San Francisco, where the Collison brothers worked to develop the platform and secure funding from investors. They officially launched Stripe in September 2011 and quickly gained traction among small businesses and startups due to its ease of use and low transaction fees. Over the time, Stripe grown into a larger company and became a major player in the online payments space, and it has now been used by many businesses and organizations worldwide.

Why Choose Stripe over Other Payment Processing Platforms?

There are a few key factors that set Stripe apart from other payment processors:

Ease of use: Stripe’s platform is designed to be easy to use, with a simple setup process and user-friendly interface. This makes it an attractive option for small businesses and individuals who may not have a lot of technical expertise.

Customizable: Stripe’s platform is highly customizable, providing a wide range of tools and APIs that developers can use to integrate the platform into their own websites and applications.

Flexibility: Stripe supports a wide range of different payment types, including credit and debit cards, as well as ACH payments, Apple Pay, Google Pay, and more. This makes it a versatile option for businesses that need to accept payments from customers in different ways.

Global: Stripe is available in many countries worldwide, which makes it a great choice for businesses that operate internationally.

Innovative: Stripe’s have been introducing new features like Stripe Capital, Stripe Issuing, Stripe Terminal and stripe treasury which make it unique in the online payment space and keep the company as a leader in the fintech industry.

Security: Stripe has a strong focus on security, with measures in place to protect both businesses and customers from fraud. The company is PCI DSS Level 1 compliant, which is the highest level of security certification available in the payment processing industry.

Who Can Benefit from Using Stripe’s Payment Processing Services?

Stripe can be used by a wide range of businesses and individuals, including:

Small businesses: Stripe is designed to be easy to use, making it an ideal solution for small businesses that need to accept payments online.

Online marketplaces: Stripe provides tools and APIs that make it easy to build and manage online marketplaces.

E-commerce businesses: Stripe can be integrated with e-commerce platforms such as Shopify and WooCommerce, providing businesses with a seamless way to accept payments for online orders.

SaaS Companies: Stripe provides subscription management, recurring billing and invoicing which is perfect for Software as a Service (SaaS) companies.

Non-profit organizations: Stripe can be used to accept donations, process membership payments, and other transactions.

Individual creators or freelancers: Stripe can help them to accept payment for their digital products or services easily.

It’s worth noting that Stripe is available in several countries, but it’s not available in all of them. In some countries Stripe have a limited service, you can check availability on the stripe website. Also note that to use stripe, businesses must comply with Stripe’s terms of service and merchant agreement and follow local laws and regulations.

Can a Limited Company in the UK Use Stripe for Payment Processing?

It is possible to use Stripe if you set up a limited company in the UK, but there are a few things to consider:

Stripe’s availability: Stripe has different levels of service availability in different countries. Even though Stripe operates in UK, it’s important to check if the service and features provided by Stripe meet your needs and if they’re compatible with your local laws and regulations.

Company registration: In order to set up a limited company in the UK, you’ll need to register the company with Companies House and comply with the relevant regulations and laws. This will require you to have a UK address and meet certain compliance requirements

Banking requirement: Stripe requires a UK bank account to process payments, therefore you should have a UK bank account set up as well.

Payment method availability: Even though Stripe supports many payment methods, it’s worth checking if the specific payment methods you need are supported in the UK.

Tax: it is important to consider the tax implications of setting up a UK company and doing business in the UK. You may need to register for UK taxes and file returns, even if you are based outside of the UK.

Dropshipping and Stripe: Understanding the Policy and How to Use it for Your Business

Yes, online entrepreneurs running a dropshipping business model can use Stripe as a payment processor. Stripe is an online payment platform that makes it easy for businesses to accept payments over the internet, so it can be used by dropshipping businesses to process payments from customers.

Dropshipping businesses typically work by selling products to customers without keeping the products in stock. Instead, the dropshipper purchases the products from a supplier and arranges for the supplier to ship the products directly to the customer. In this model, Stripe can be used to process the payments from customers before the order is placed with the supplier.

Stripe can be integrated with popular e-commerce platforms like Shopify and WooCommerce and can be used to accept payments from customers via credit or debit card, bank transfer, or other supported payment methods.

Additionally, Stripe also provides subscription management and recurring billing, which makes it a good option for dropshipping businesses that also sell subscription products or services.

It’s worth noting that as with any business model, it is important to comply with all relevant laws and regulations, including those related to tax and consumer protection, even if your business operate as dropshipping.

Stripe does have certain restrictions on the use of its services for dropshipping businesses.

Stripe’s merchant agreement states that businesses using its services must be the “seller of record” for the goods or services they sell. This means that the business must have legal ownership of the goods or title to the services they sell before they offer them to the customers.

In the case of dropshipping, the business owner typically does not own the goods being sold, but instead purchase them from a supplier after the customer has placed an order. This means that the business would not be the seller of record and would not be able to use Stripe’s services, at least not in the traditional sense.

However, there are some possible ways for a dropshipping business to use Stripe services:

One approach is to use a pre-order model, where payments are collected in advance before an order is placed with a supplier. This would allow the business to be the seller of record for the goods, and therefore, would qualify to use Stripe.

Another option is using Stripe for some aspect of the business, for example for digital products or services, that the business is the owner and can be considered as the seller of record.

A third approach is for the dropshipper to form a partnership with the supplier or manufacturers, with the latter also registered on Stripe, and the both work together, this way the dropshipper can use Stripe to process payment from the customers and the supplier uses Stripe to receive the payments.

Preparing Your Website for Approval with Stripe: Key Factors to Consider

In order to be approved by Stripe to use their payment processing services on your website, there are a few key things that you’ll need to prepare:

Legal Business Information: You will need to provide Stripe with your business name, address, phone number, and other legal information. You’ll also need to provide documentation to prove your business’s identity and compliance with relevant laws and regulations.

Website & Content: Your website should have a clear and professional design, with information about your business and the products or services you offer. You should also have a privacy policy, terms of service, and refund policy prominently displayed on your website, with your contact information and return address.

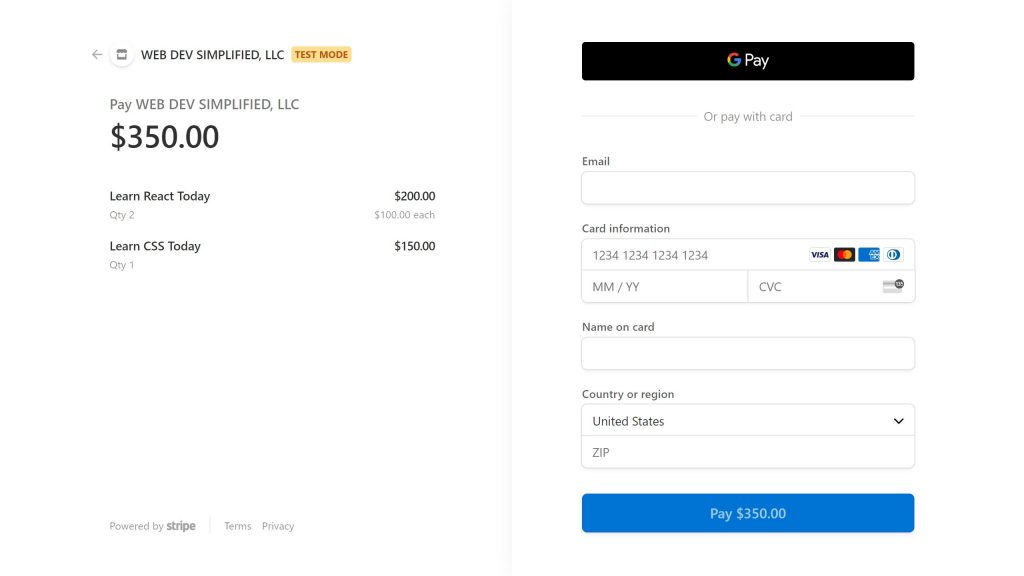

Secure &compliant checkout : Your website’s checkout process should be secure, meaning it should use HTTPS and SSL certificates to encrypt customer information and protect against fraud. In addition, the checkout should be compliant with relevant laws, industry standards, and Stripe’s policies.

Compliance with Payment card industry: Your website must be PCI compliant, which is a security standard for organizations that handle credit and debit card information. Stripe provides some tools and documentation to help you with compliance but it’s important to make sure that you comply with all the requirements before integrating with Stripe.

Identity verification: Stripe may also ask for some personal identification documents, like a passport or driver’s license and proof of address, to verify your identity and that of your business.

It’s important to note that Stripe can have different policies and procedures depending on the country, it’s a good idea to check with Stripe’s support team or legal representative to know more about their policies in specific regions and stay updated with them as they might change over time.

Non-UK resident owned limited companies can use Stripe to process payments.

Yes, a non-UK resident owned limited company can use Stripe to process payments. Stripe is available in many countries worldwide and supports a wide range of currencies, so as long as the company is based in a country where Stripe is supported, it can use the platform to accept payments from customers. However, it’s important to note that depending on the country of the company, some features or functionalities might be restricted. And also before signing up for

Stripe, the company will have to follow the Stripe’s terms of service, which includes requirements for collecting taxes and verifying the business information, and also ensure compliance with relevant laws and regulations.

How Launchese Can Assist Entrepreneurs in Setting Up a UK Company, Obtaining a Business Bank Account, and Getting Approved by Stripe

Launchese is a platform that aims to help entrepreneurs set up their business in the UK, providing support with company registration, banking and compliance in order to use Stripe.

Here are some of the key ways that Launchese can help entrepreneurs:

Company registration: Launchese can help entrepreneurs with the process of registering their company with Companies House, which is the government body responsible for registering and regulating limited companies in the UK. This includes helping with documentation and paperwork required for the registration process.

Business banking: Launchese can also help entrepreneurs with setting up a UK business bank account, which is typically a requirement for using Stripe. This may involve helping with the application process, providing documentation and working with the bank to ensure that the account is set up correctly.

Compliance & Regulations: Launchese can help entrepreneurs to ensure that their business is compliant with relevant laws and regulations in the UK, particularly in relation to taxes and consumer protection. This can involve providing advice and guidance on the specific requirements of the business.

Stripe Approval: Launchese can help entrepreneurs with the process of getting approved by Stripe. They can provide guidance on the requirements needed to be approved by Stripe, such as website design, legal documentation, compliance and identity verification. They may also be able to provide assistance with integrating the Stripe API into the entrepreneur’s website.

By using Launchese services, entrepreneurs can save time and effort in setting up their business in the UK and in getting approved by Stripe. It’s always worth double checking the authenticity and reputation of the service provider before engaging with them, and to check if they have Stripe’s official support or partnership.