When you incorporate your company in the UK, it can be a bit of a mine field trying to navigate all the terminology involved. One of the most important pieces of information relevant to your company is the CRN, which is the Company Registration Number.

In this article we’re going to explain exactly what a Company Registration Number is, where you can find your CRN, how you get one and we’ll also cover a few other important bits of information that you should know about your CRN.

What is a Company Registration Number?

When you incorporate your company in the UK, you are allocated a unique 8-character identifier called your Company Registration Number, or CRN for short.

You may also hear this number referred to as a Companies House Registration Number, which makes sense considering Companies House are the ones that allocate your CRN to you.

Your CRN is a unique number that identifies only your incorporated company, no others.

It is important to note that your CRN may actually have letters at the start, depending on where your company is based. Limited Companies in Scotland for example will begin with “SC”, followed by 6 numbers.

Customer Registration Numbers are always 8 characters in total.

Where Can I Find My Company Registration Number?

When your company is incorporated, you will receive a certificate of incorporation from Companies House. Your CRN is very clearly printed near the top of this certificate.

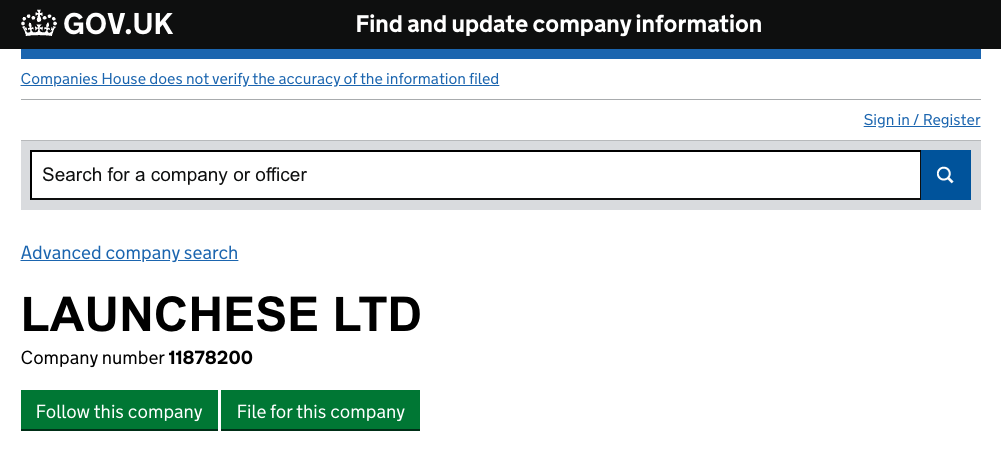

You can also search online very easily on the UK Gov website.

You simply type in the name of your company and you’ll get access to a the public information available for that company.

If you can’t find your certificate of incorporation and you can’t access the UK Gov website for whatever reason, your CRN is also usually printed on other piece of information sent to you from Companies House.

This might include letters or emails that are specifically sent to you about your company.

Is My CRN the Same As My UTR?

Your Unique Taxpayer Reference is a completely different number to your Company Registration Number, don’t get them confused!

Your UTR is an equally important number that you need to know, but it relates your tax affairs and helps identify your company when you are filing your self-assessment tax returns.

Do Sole Traders Have a Company Registration Number?

Sole Traders are not formed in the same way so they do not have a Customer Registration Number. General Partnerships also do not have CRNs.

Only Limited Companies and Limited Liability Partnerships have a CRN.

When Do I Need To Use My Company Registration Number?

Your CRN should be display on all formal company documents such as letters, invoices, order forms etc. You should also display your CRN on your company website.

You will also need your CRN if you are opening business bank accounts, dealing with Companies House, applying for a bank loan or other official company business.

Thanks for taking the time to read our article about Company Registration Numbers in the UK, we hope it answered any important question you had.

If you need help with your UK company formation, please feel free to take a look at the services we offer at Launchese.

Thanks again, until next time!