If you’re starting a new company in the UK, there’s bound to be some moments when you’ve scratched your head and asked “what does that mean” or in this case, “what is a company UTR Number!?”

Well, the good news is that you’re not alone.

There are so many different things involved in setting up your online business, let alone all the different rules, terms, definitions, and obligations involved in setting up a Limited Company in the UK.

In this article, we’re going to let you know exactly what a UTR number is, how you can apply for one and what is exactly a UTR number is used for.

What is a UTR Number?

A UTR is an abbreviation for Unique Taxpayer Reference.

HMRC (HM Revenue and Customs) issues a personal UTR to any person that registers for self-assessment and they also issue a UTR to all newly incorporated companies.

It is very important to note that you cannot use your personal UTR, if you have one, for your company. You will be issued a completely separate UTR for your new company when it is established.

Where Can I Find My UTR Number and What Does it Look Like?

Your Unique Taxpayer Reference is a 10-digit number that can be found in your HMRC online account and on any tax return notices that are sent to you from HMRC.

Sometimes your UTR might simply be referred to as “tax reference” but if there is ever any confusion you should check your online account or contact HMRC directly.

Why Do I Need a UTR?

If you’re self-employed or you’ve set up a Limited Company, you are required to file self-assessment tax returns.

This means that you need to have a UTR so your tax affairs can easily be identified and associated with your business.

As with any government body that oversees tax or business affairs, HMRC monitors and tracks tax obligations, and having a UTR helps with this. This isn’t necessarily bad news, it could also mean that you might be informed that you’re owed a refund if you have overpaid your tax.

If you partner with an Accountant to assist with your company tax then they will need to know your UTR.

How Do I Apply For a UTR Number?

Once you have formed your new Limited Company, Companies House will advise HMRC and you will receive a letter with your Company UTR. This letter will be sent to your registered address.

If you are a customer of Launchese then we will let you know once your company UTR has been issued.

How Long Does It Take To Get a UTR Number?

Once your company has been incorporate and Companies House has informed HMRC, you will receive a letter to your registered address within 14 days.

Need Help Setting Up a UK Limited Company?

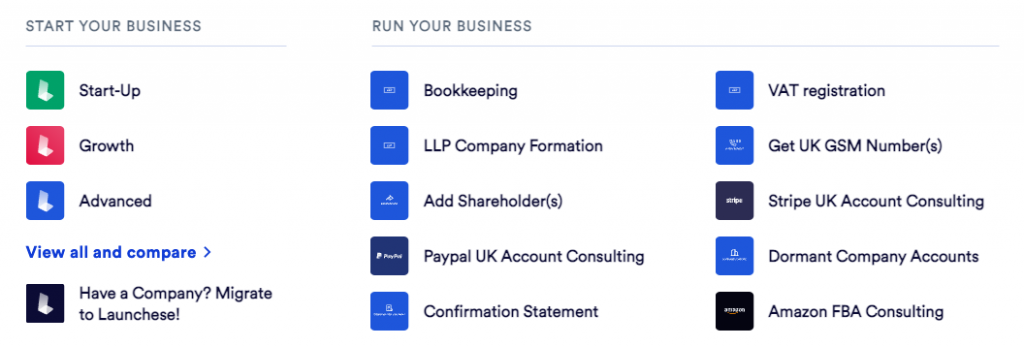

At Launchese we offer a wide range of services to help you start, run and maintain your UK Company from within the UK or abroad.

If you are running an online business from outside of the UK we would love to hear from you in our Facebook Group where we offer support and guidance for all your UK Company Formation questions.